Released May 31 2024

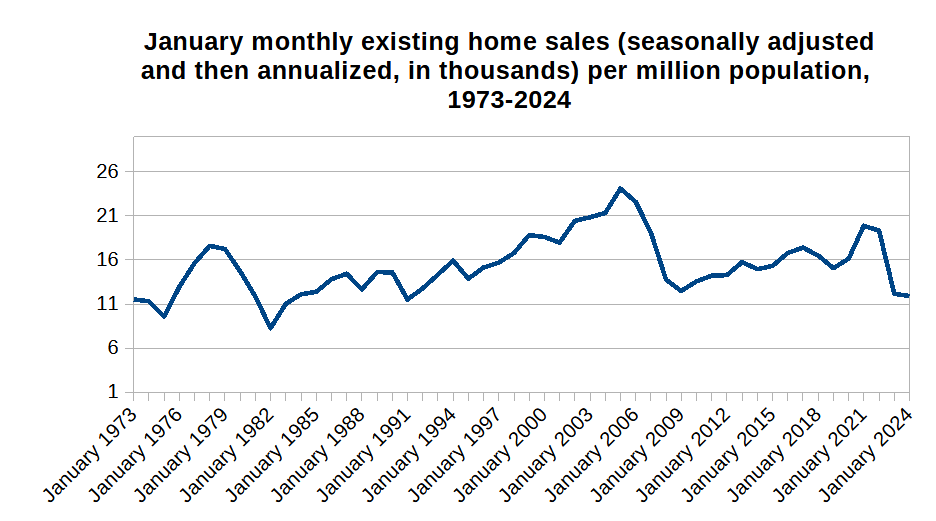

I) In real terms (indexed to per million population) existing US home sales are 50+% below the 50-year high and are at a 40-year low.

II) Frequency/volume of existing home sales are an economic leading indicator

[Credit: this analysis was developed with the aid, contribution, research and number-crunching of our staff economist, Dinara Omuralieva.]

A) Why is this important to know?

a) For both prudently managing the current economic situation and for the future planning by governments, institutions, businesses and by individuals for their portfolio management.

b) It is an indicator of economic activity, a component of the overall economic health of a nation. There is an old adage, that every high is followed by a low and every low is followed by a high.

The frequency/volume of existing home sales is (an approximate 1-3 year) leading indicator of the level/direction of home sale prices, economic activity and S&P 500 performance.

The tops (frequency of home sales) are leading indicators of home sales price drops, of recessions and of S&P 500 drops (that is, we are about to have them now, some may be well underway, and/or starting after the federal economic stimulus stops which proceeds an election).

This also applies to the rise of the curve, the lows are followed by new highs.

See material below at bottom of the page in Section 5.

c) It has an impact on tax revenue (transfer fees and transfer-based taxes).

d) It is an insightful indicator for planning by businesses that are reliant on this activity (banking, real estate brokers/agents, mortgage originators, foreclosure industry, legal industry transfers/foreclosure/bankruptcy, home builders/developers, home supply industry interior/exterior/retail-building-supply and more). Planning for inventory, personnel/employment/unemployment, office space, selling and distribution infrastructure.

Thus it impacts the supply/demand curve in this consumer-based economy.

e) When this data is applied to the supply demand curve, where home sales prices are still rising according to the S&P CoreLogic Case-Shiller Home Price Index, and are are about neutral according to the Federal Housing Finance Agency, it appears that the top of the price curve has been about reached and/or the price curve is now sloping down in some regions. See Section 4 below for more information and links.

B) The data as it is “spinned”, is shown here

and once a month in many popular media news reports.

1) Problems with the data:

A) the data is controlled by the National Association of Realtors (NAR), an industry group that promotes its own agenda, irrespective of the needs of others.

This is the trade group that in March 2024 agreed to pay a $418 million settlement over their unfair commission fees

B) everyone, government/private, accepts and uses this data as the gospel truth. Even the Census Bureau does not independently track existing home sales data and instead accepts the NAR data. Government planning is based on this NAR “data”.

C) the data is scientific mud, it cannot be independently replicated nor validated. The data uses nominal numbers, a subjective presentation from a so-called sample of Multiple Listing Service Boards. A fuller description is below in Section 3.

D) as the data is in nominal numbers, it does not reflect the empirical reality of a growing population, and thus it is a false presentation. It is a fallacy of logic, to make something sound scientific and exact to lead a person to accept a false position as being true.

2) After extensive research, we have been unable to find any scientifically coherent data that has been collected to empirically count existing home sales.

So, we have taken the NAR data as reported to TradingEconomics.com at face value and adjusted it per million population.

https://tradingeconomics.com/united-states/existing-home-sales

Here is the recalculated data, from nominal to real.

It shows that in real terms (indexed to per million population) existing home sales are 50+% below the 50-year high (January 2005) and are now at a 40-year low.

First the chart, and then below it the underlying data:

| Existing homes sold in each January for the period 1973 to 2024 | ||||

| Period | Population (not seasonally adjusted), in thousands | January month existing homes sales that are seasonally adjusted and then annualized, in thousands | January month existing home sales that are seasonally adjusted and then annualized, per million population | January month existing home sales that are seasonally adjusted and then annualized, per million population, in thousands |

| January 1973 | 211,053 | 2,430 | 11,513.70 | 11.514 |

| January 1974 | 213,003 | 2,410 | 11,314.39 | 11.314 |

| January 1975 | 214,998 | 2,060 | 9,581.48 | 9.581 |

| January 1976 | 217,172 | 2,810 | 12,939.05 | 12.939 |

| January 1977 | 219,262 | 3,430 | 15,643.39 | 15.643 |

| January 1978 | 221,553 | 3,900 | 17,603.01 | 17.603 |

| January 1979 | 223,973 | 3,860 | 17,234.22 | 17.234 |

| January 1980 | 226,554 | 3,330 | 14,698.48 | 14.698 |

| January 1981 | 229,004 | 2,710 | 11,833.85 | 11.834 |

| January 1982 | 231,235 | 1,910 | 8,260.00 | 8.260 |

| January 1983 | 233,398 | 2,570 | 11,011.23 | 11.011 |

| January 1984 | 235,456 | 2,850 | 12,104.17 | 12.104 |

| January 1985 | 237,535 | 2,940 | 12,377.12 | 12.377 |

| January 1986 | 239,713 | 3,310 | 13,808.18 | 13.808 |

| January 1987 | 241,857 | 3,490 | 14,430.01 | 14.430 |

| January 1988 | 244,056 | 3,090 | 12,661.03 | 12.661 |

| January 1989 | 246,301 | 3,600 | 14,616.26 | 14.616 |

| January 1990 | 248,743 | 3,630 | 14,593.38 | 14.593 |

| January 1991 | 252,012 | 2,900 | 11,507.39 | 11.507 |

| January 1992 | 255,331 | 3,260 | 12,767.74 | 12.768 |

| January 1993 | 258,799 | 3,710 | 14,335.45 | 14.335 |

| January 1994 | 262,021 | 4,170 | 15,914.75 | 15.915 |

| January 1995 | 265,157 | 3,680 | 13,878.57 | 13.879 |

| January 1996 | 268,258 | 4,060 | 15,134.68 | 15.135 |

| January 1997 | 271,472 | 4,260 | 15,692.23 | 15.692 |

| January 1998 | 274,732 | 4,610 | 16,779.99 | 16.780 |

| January 1999 | 277,891 | 5,230 | 18,820.33 | 18.820 |

| January 2000 | 281,083 | 5,230 | 18,606.60 | 18.607 |

| January 2001 | 283,960 | 5,100 | 17,960.28 | 17.960 |

| January 2002 | 286,739 | 5,860 | 20,436.70 | 20.437 |

| January 2003 | 289,412 | 6,030 | 20,835.35 | 20.835 |

| January 2004 | 292,046 | 6,230 | 21,332.26 | 21.332 |

| January 2005 | 294,768 | 7,100 | 24,086.74 | 24.087 |

| January 2006 | 297,526 | 6,720 | 22,586.26 | 22.586 |

| January 2007 | 300,398 | 5,740 | 19,107.98 | 19.108 |

| January 2008 | 303,280 | 4,170 | 13,749.67 | 13.750 |

| January 2009 | 306,035 | 3,820 | 12,482.23 | 12.482 |

| January 2010 | 308,706 | 4,190 | 13,572.78 | 13.573 |

| January 2011 | 311,204 | 4,420 | 14,202.90 | 14.203 |

| January 2012 | 313,636 | 4,480 | 14,284.07 | 14.284 |

| January 2013 | 316,038 | 4,980 | 15,757.60 | 15.758 |

| January 2014 | 318,464 | 4,760 | 14,946.74 | 14.947 |

| January 2015 | 320,997 | 4,920 | 15,327.25 | 15.327 |

| January 2016 | 323,509 | 5,430 | 16,784.70 | 16.785 |

| January 2017 | 325,901 | 5,670 | 17,397.92 | 17.398 |

| January 2018 | 327,969 | 5,410 | 16,495.46 | 16.495 |

| January 2019 | 329,766 | 4,970 | 15,071.29 | 15.071 |

| January 2020 | 331,443 | 5,350 | 16,141.54 | 16.142 |

| January 2021 | 332,007 | 6,600 | 19,879.10 | 19.879 |

| January 2022 | 332,933 | 6,430 | 19,313.20 | 19.313 |

| January 2023 | 334,433 | 4,070 | 12,169.85 | 12.170 |

| January 2024 | 336,194 | 4,000 | 11,897.89 | 11.898 |

3) below is the extended description of the NAR data from MortgageNewsDaily.com

(see towards bottom of the page at this link:)

About This Data

Existing Home Sales report on the number of completed real estate sales transactions on single-family homes, townhomes, condominiums and co-ops.

Each month the National Association of Realtor® receives data on existing-home sales from local associations/boards and multiple listing services (MLS) nationwide. NAR captures 30-40% of all existing-home sale transactions with its monthly survey.

The methodology in calculating existing-home sales statistics is really quite simple. The monthly EHS economic indicator is based on a representative sample of 160 Boards/MLSs. The home sales data (raw data) is divided into the four census regions: Northeast, South, Midwest and West. The raw sales volume from the participating Boards/MLSs is carefully evaluated by NAR economists to ensure accuracy. Some of the possible problems with the data could be caused by:

- Changes in association/board/MLS physical jurisdiction

- Changes in MLS vendors and /or staff

- Lack of response by associations/boards

- Erroneous data

Once the “problematic data” have been extricated from the sample, the aggregated raw volume figures are weighted to accurately represent sales activity for each region of the country. This is also called the non-seasonally-adjusted volume. The weights are benchmarked every 10 years to reflect shifts in regional demand. The non-seasonally adjusted volume is then converted into seasonally-adjusted annualized rates.

Median and mean (average) prices are computed for the nation and four census regions on a monthly basis. Median prices are also calculated for selected metropolitan areas and are reported quarterly to give adequate time for data gathering.

Due to the nature of the distribution of home sales prices, the mean sales price is usually higher than the median price. There is a slight degree of seasonal variation in reporting selling prices. Sales prices generally experience the largest gains in the summer months, as favorable weather conditions create an ideal atmosphere for buying and selling a home. Demand for homes usually hits its seasonal peak in the third quarter, and strong price appreciation generally follows suit, and then declines moderately over the next three months. Despite the slight seasonal variances that exist in the price series, sales prices are not seasonally adjusted. The reason for this is that seasonal variances are extremely fickle and difficult to gauge. Furthermore, changes in the characteristics and size of a home have a more pronounced effect on home prices.

4) The direction of price movements are about neutral (rising in same regions and falling in other regions) based on mortgage data from Freddie Mac and Fannie Mae, according to the Federal Housing Finance Agency. The S&P CoreLogic Case-Shiller Home Price Index, which measures homes in 20 major cities, is value-weighted, meaning price trends for higher-valued homes tend to have more of an impact on their Index.

From May 28, 2024 from TradingEconomics.com

https://tradingeconomics.com/united-states/house-price-index-mom

“The average prices of single-family houses with mortgages guaranteed by Fannie Mae and Freddie Mac in the United States edged higher by 0.1% in March of 2024, well below market expectations of a 0.5% increase, and slowing considerably from the 22-year high surge of 1.2% noted in the previous month. Regarding different census divisions, declines in the Pacific (-1%), New England (-0.7%), East South Central (-0.4%), and Mountain (-0.2%) offset a sharp increase in the Middle Atlantic (1.5%), while home prices were loosely stable in the South Atlantic (0.1%) and the West North (0%). From the previous year, house prices rose by 6.7% in March, slowing from the upwardly revised, 17-month high of 7.1% in February. source: Federal Housing Finance Agency“

Also from May 28, 2024, based on their methodology, the S&P CoreLogic Case-Shiller Home Price Index MoM, as would be expected, shows a higher price increase and false reasoning.

https://tradingeconomics.com/united-states/case-shiller-home-price-index

“The S&P CoreLogic Case-Shiller 20-City Composite Home Price Index, which measures home prices in 20 major US cities, rose to a fresh record high of 325.09 on March of 2024. The figures pointed to a 7.4% increase from the previous month, above market estimates of 7.3%, as tight inventory and a strong US economy supported home prices and outweighed high interest rates by the Federal Reserve. source: Standard & Poor’s“

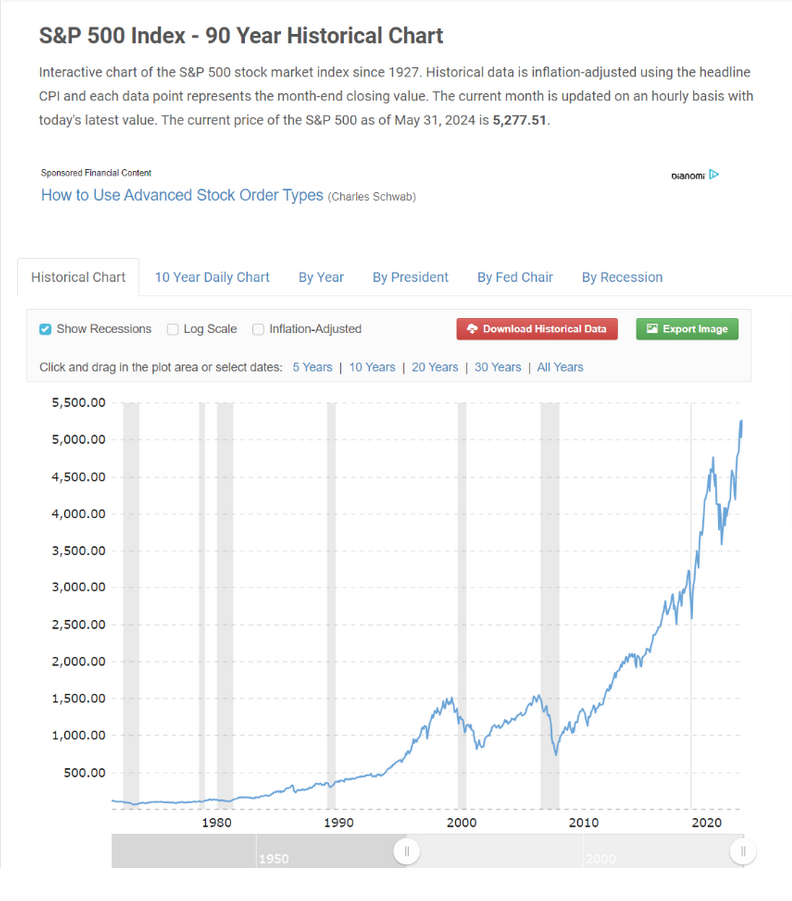

5) The tops (frequency of home sales) are leading indicators of home sales price drops, of recessions and of S&P 500 drops (that is, we are about to have them now and some may be well underway, and/or starting after the federal economic stimulus stops which proceeds an election).

This also applies to the rise of the curve, the lows are followed by new highs.

The first chart below shows recessions with their S&P 500 drops.

The chart below it shows the home sales price drops with each recession.

The tops in frequency of home sales precede most recessions by about 1-3 years.

Years with frequency of sales tops Years with start of “official” recessions

1978 1979

1981

1987

1989 1990

1994

2001

2005 2007

2017 2020

2021-2022

https://www.macrotrends.net/2324/sp-500-historical-chart-data

https://fred.stlouisfed.org/series/MSPUS

….